Ghana’s balance of trade is set to receive support from cocoa export and oil production revenues this year according to researchers at Standard Bank, parent company of Stanbic Bank Ghana. This was contained in the April edition of the African Local Markets Monthly report prepared by Standard Bank.

According to the report, “after strong economic growth in 2017, reaching 8.5 percent year-over-year, we expect growth to remain robust at around 7.0 percent year-over-year in 2018. The Stanbic Bank PMIs are certainly corroborating this view thus far. The overall PMI reached 55.2 in March from 54.9 in February and 53.5 in March 2017, as survey respondents suggested that output levels were rising as consumer confidence and consequently new orders rose. That being said, the oil sector will continue to underpin growth as authorities estimate that production is set to reach a peak of 290k bpd in 2018”.

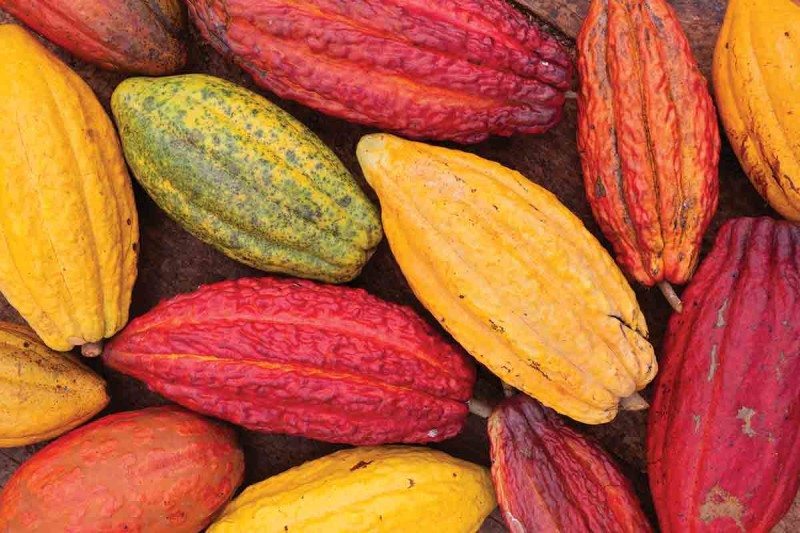

The report further indicates that the Ghanaian economy is expected to remain strong due to increased cocoa export revenues. “Ghana’s trade balance should receive a boost from increased cocoa export revenues. Since beginning of the year, cocoa prices have risen by over 40 percent to around US$2,700/mt as demand-supply dynamics appear to have adjusted to the lower price environment that was prevalent in 2017. Given that imports declined last year – leading to the trade deficit swinging into a surplus – and our expectation of only a moderate rebound this year, the trade balance should remain in surplus and allow further contraction of the current account deficit.” the report said.

Commenting on the report, the Head of Global Markets at Stanbic Bank Ghana, Afua Bulley, said the rise in global cocoa prices will have an impact on the country’s Treasury. “The recent rise in cocoa prices will have a reasonably positive impact on the fiscus. Unlike in Cote d’Ivoire where the cocoa board reduced prices it paid to farmers, Ghana refrained from reducing prices – thus placing some pressure on the country’s fiscal accounts. The 40 percent surge in cocoa prices since beginning of the year should certainly reduce the implied subsidy and alleviate fears of impending fiscal strain,” Ms. Bulley indicated.

“We also expect financial reserves to remain buoyant, especially after planned Eurobond issuances which may amount to US$2.5billion later in the year. As a result, we now expect reserves to reach around US$6.8billion by year-end,” Ms. Bulley added.

The African Local Markets Monthly also predicts that prolonged disinflation and the proposed reduction in electricity tariffs by some 12% is likely to push the Bank of Ghana to cut its policy rate by another 300 bps in the course of the year. The report said: “After delivering a 200bps cut at the March MPC meeting, we expect the BoG to cut the policy rate by another 300 bps through the course of the year”.

According to the report, these developments provide a basis for further easing of the monetary policy stance by the central bank – although this is likely to be restrained by uncertainty within the banking sector as a result of the new minimum capital requirement.

“Given the trajectory for inflation and non-oil economic growth, there is an argument for further easing of the monetary policy stance taken by the BoG. Such an aggressive easing in monetary policy may well result in a substantial rise in private sector credit and may actually result in higher US$/GH¢. However, our suspicion is that said easing in monetary policy will probably be restrained by uncertainty within the banking sector, as capital requirement changes have ensured that most banks have taken a defensive posture to asset origination,” the report noted.

The African Local Markets Monthly is a monthly report issued by the Standard Bank Group and focuses on the economic and financial outlook of African countries. The report also reviews current economic situations and makes short- to medium-term predictions about the economies of African countries.

Source: thebftonline.com